Our Solution

All Sollution

Acquirer Processing

The advanced and actual trade scenes are blending and purchasers presently don’t adhere to a solitary channel, or even a solitary country, for purchasing what they need. Traders need to convey a smooth client experience – and they need your assistance to convey it.

Support consumer choice

With Corporation Data Analyst acquirer handling arrangement, you can empower your traders to help with significant card plans, alongside popular installment strategies like Person-to-Person Payments and memberships.

Extend your reach

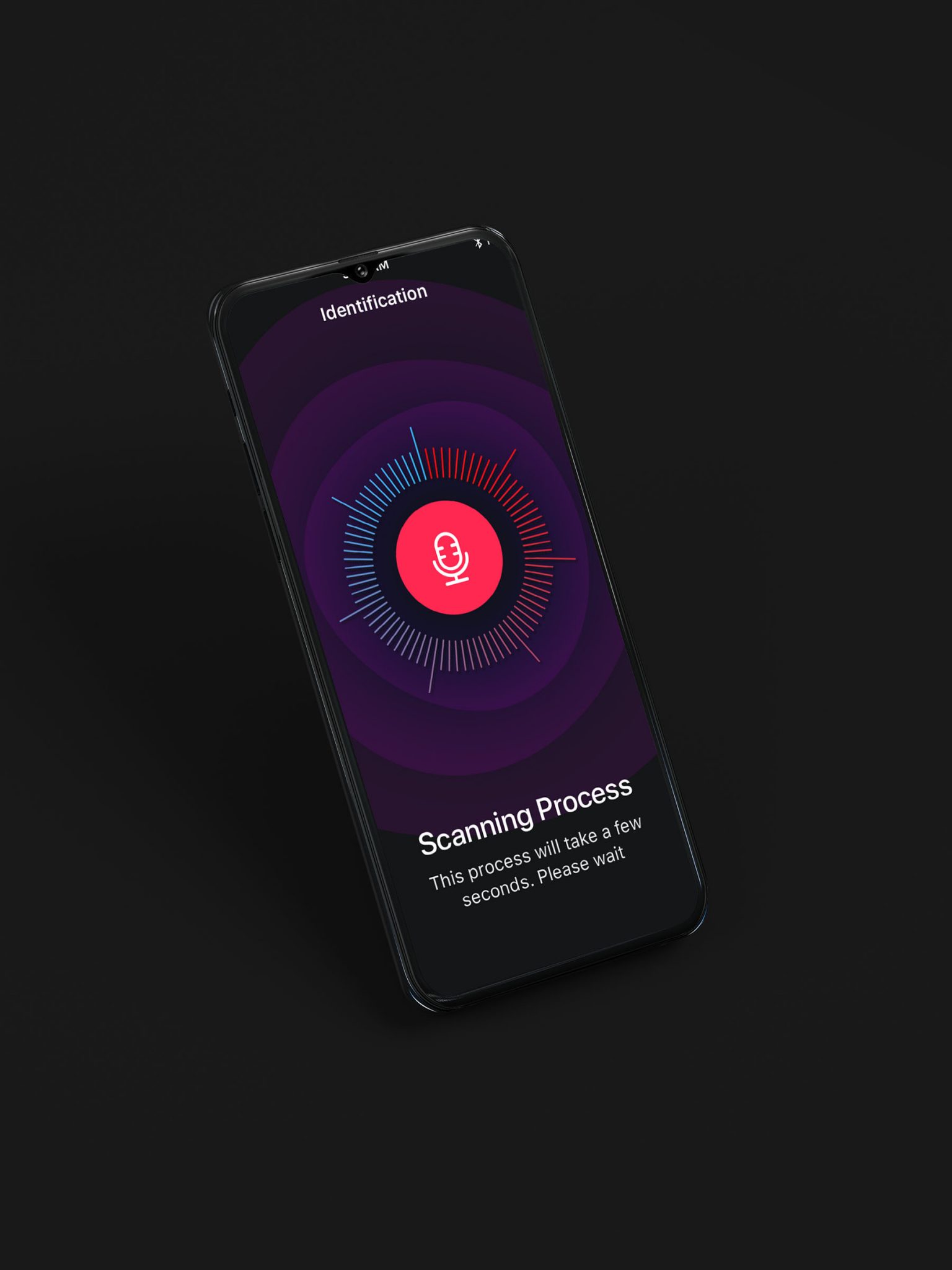

We can uphold installments from any channel and any gadget type, including on the web, portable, in-person POS and MOTO exchanges. Corporation Data Analyst answer additionally upholds multi-cash handling, so your dealers can fit monetary standards to suit their customers.

Tap into data

Get continuous notices, view live exchanges, and gain from ongoing information examination in the Corporation Data Analyst hub dashboard to acquire better client knowledge and noteworthy insight.

All Sollution

Streamline costs and the client experience

The present eCommerce world is quick, borderless, and hazard inclined. Your dealers need the apparatuses, information, and mastery to stay aware of purchaser interest and take advantage of development lucky breaks.

With the right innovation set up, you can offer your vendors precisely what they need to convey the right client experience and drive deals.

Support consumer choice

Allow your shippers to help the installment strategies their clients like by tolerating cards, elective installment techniques, repeating installments, bank-based installments, and cryptographic forms of money. Corporation Data Analyst Payment Gateway can likewise uphold installments in neighborhood monetary forms and various channels.

Solve merchant challenges

We can uphold dynamic exchange directing, giving your dealers a fallback choice for strength, alongside the capacity to support acknowledgment and lessen costs by steering to the most ideal decision acquirer. Add debate the executives and chargeback handling to assist with overseeing misrepresentation and expenses.

Reduce compliance costs

Our PCI consistent installment entryway diminishes your consistency trouble and the requests on your in-house assets. You can likewise join the entryway with our 3D Secure arrangement, to further develop your confirmation cycles and meet your PSD2 consistency commitments for SCA.

Blog and News

Latest News

How is Open Banking changing financial services?

Open Banking had a sluggish beginning. In 2019 controllers reproved banks for neglecting to comply with the time constraints they...

What sectors will be most affected by 5 technologies?

We asked respondents from our what technologies would have the most impact across sectors, and it revealed a similar pattern,...

Why consumers don’t care about fintech…

As little as a couple of years prior, fintech began to acquire a foothold with customers through basic advantages, like...